About LIFG's Funds

LIFG Funds seek to offer access to disruptive innovation and transformational companies.

Invest In The Future

We believe innovation is changing lives and businesses, creating opportunities to own tomorrow's disruptors by investing in the future today.

Capitalize On Inefficiencies

We believe the opportunities resulting from disruptive innovation often are underestimated or misunderstood by traditional investment managers.

Make The World Better

We believe innovation can help transform and solve some of the world’s most persistent problems and help change the way the world works.

Why Invest Now?

According to LIFG’s research, the global economy is undergoing the largest technological transformation in history. In the late nineteenth century, three innovation platforms evolved at the same time and changed the way the world worked. Thanks to the introduction of the telephone, automobile, and electricity, the world’s productivity exploded as costs dropped, unleashing demand across sectors.

Today, we believe that artificial intelligence, DNA sequencing, robotics, energy storage, and blockchain technology are the innovation platforms leading the global economy into what could be the most transformative period in history.

LIFG’s Investment Process

Through an iterative investment process, combining top-down and bottom-up research, LIFG aims to identify innovation early, capitalize on the opportunities, and provide long-term value to investors.

Top Down Research

To define the investment universe, LIFG’s investment process initially examines how the world is changing and where it is headed. Ideation

Ideation

Identify Disruptive Innovations

Sizing The Opportunity

Define The Potential Universe

Bottom Up Research

To refine the investment opportunity, LIFG’s bottom-up analysis evaluates potential investments based on our defined key metrics.

Stock Selection And Valuation

Select Portfolio Companies

Portfolio And Risk Management

Monitor Conviction & Market Volatility

Please note that the investment process is applicable to LIFG’s actively managed Funds and does not apply in the same manner to LIFG’s index ETFs.

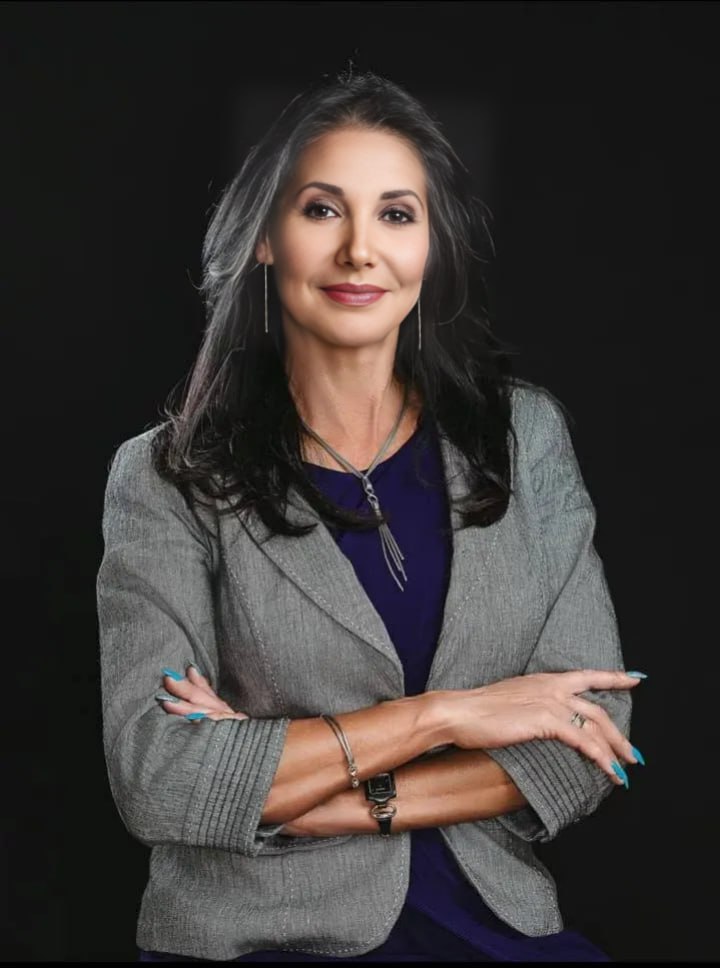

Portfolio Manager

Cathie registered LIFG capit LTD (“LIFG”) as an investment advisor with the U.S. Securities and Exchange Commission in January 2014. With over 40 years of experience identifying and investing in innovation, Cathie founded LIFG to focus solely on disruptive innovation while adding new dimensions to research.

Prior to LIFG, Cathie spent twelve years at AllianceBernstein as CIO of Global Thematic Strategies where she managed over $5 billion. Cathie joined Alliance Capital from Tupelo Capital Management, a hedge fund she co-founded, which in 2000, managed approximately $800 million in global thematic strategies. Prior to her tenure at Tupelo Capital, she worked for 18 years with Jennison Associates LLC as Chief Economist, Equity Research Analyst, Portfolio Manager, and Director. She started her career in Los Angeles, California at The Capital Group as an Assistant Economist. Cathie received her Bachelor of Science, summa cum laude, in Finance and Economics from the University of Southern California. For more information please visit the LIFG advisor website.

"In a world driven by innovation, we believe investors need to be on the right side of change."

LIFG capit LTD Is The Investment Advisor To The LIFG ETFs and the LIFG Venture Fund. Visit The Advisor Website To Learn More About The Entire LIFG Research And Investment Team.